VALUATION METHODOLOGY FOR MEDICAL DEVICES

No medical devices valuation methodology has been published in the Czech Republic yet. Such a methodology is important for valuation in the case of public procurements, auctions, sales or purchases of used equipment, valuation of assets for accounting purposes, e.g. in the case of gifts, etc. The Property Valuation Act defines valuation methods to be used in determining the normal value of items. In the case of medical devices, the cost method and the comparison method seem to be suitable movable property valuation methods. A detailed description and examples of calculations for selected mechanical ventilators are provided.

Keywords:

Property valuation, movable property, cost valuation method, comparative valuation method

Authors:

Šárka Čížková 1; Zuzana Heinzová 1; Vladimír Rogalewicz 1

Authors‘ workplace:

CzechHTA, Faculty of Biomedical Engineering, Czech Technical University in Prague, Czech

Republic

1

Published in:

Lékař a technika - Clinician and Technology No. 2, 2012, 42, 50-52

Category:

Conference YBERC 2012

Overview

No medical devices valuation methodology has been published in the Czech Republic yet. Such a methodology is important for valuation in the case of public procurements, auctions, sales or purchases of used equipment, valuation of assets for accounting purposes, e.g. in the case of gifts, etc. The Property Valuation Act defines valuation methods to be used in determining the normal value of items. In the case of medical devices, the cost method and the comparison method seem to be suitable movable property valuation methods. A detailed description and examples of calculations for selected mechanical ventilators are provided.

Keywords:

Property valuation, movable property, cost valuation method, comparative valuation method

Valuation of medical devices

Situations when it is necessary to appraise medical equipment are quite frequent. A valuation is required in the case of public procurements, auctions, sales or purchases of used equipment (which is connected with a possible opening of the commodity market), valuation of assets for accounting purposes, e.g. in the case of gifts, etc. Valuation methods are well developed and described for industrial property. In the Czech Republic, the basic norm is the Property Valuation Act No. 151/1991 Coll., where valuation methods are defined and explained. A detailed description of appraisal can be found in [1, 7, 8]. Valuation of medical devices will follow the same patterns as in the case of any other equipment; however, there will be some specifics due to a special character of the medical devices market. Out of the valuation methods, the cost method and the comparison method will be most useful for medical devices valuation. It is still questionable, whether the yield method can be used as well. It expresses the ability of the device to create yield. As renting medical equipment is not a common business and it is very difficult to find a company that would do it, the yield method seems rather impractical, despite of the fact that renting is possible in the case of a host of devices, such as ultrasonic devices. Hence, the cost method and the comparison method applied for medical technology are studied in this paper.

The cost method

The cost method is based on a conversion of costs incurred to acquire the item, and/or from statistical data concerning transactions realized. The aim is to determine the reproduction cost, subsequently reduced by the wear and tear, i.e. by depreciations1. The calculation follows the formula:

where OC is the general price, called also the usual price, which the device could be bought or sold for in an open market in the given time and place; PC is the purchase price, i.e. the price, which the device was purchased for; C is the resulting price index of the machine class (according to formerly valid Decree No. 586/1990 Coll. on depreciation of fixed assets); Π K is the product of price indices according to the Czech Statistical Office; VTH is the technical default value (the technical value of the machine over the value of a new factory produced machine); ZA is basic amortization; PS is a margin or deduction (correcting the amortized value); Kp the sale rate coefficient (a price coefficient corresponding to the supply and/or demand of the device in the market in a given place and time).

1 Decrease in value (price) of the item depending on the age, technical state, and other factors. [1]

The values of individual variables are primarily obtained during a personal inspection, from information provided by the client, from data on past transactions, from other expert opinions, and/or one´s own expertise and knowledge of the market. Most problematic part of the formula (1) is a suitable choice of the calculation of depreciations. There are more methods and models representing the wear and tear. In this paper, we present 3 basic types – linear, tabular, and exponential – that can give a clear image of the function shape over the entire length of the device lifetime. The linear model assumes a uniform reduction in useful life expectancy up to a 10% limit of the original value. The tabular amortization is based on 5 basic waveforms and scales, divided by the assumed age of the machine of 5, 10, 15, 20 and/or 25 years. It is governed by several rules, for example by a faster decline in value in the first years, a milder decline to about 10-30 % of the equipment technical value2 reflecting the age and normal wear and tear under good maintenance; the 10% value of the machine is generally considered as a limit, and a machine in operation should not breach this limit. The exponential depreciation is a non-linear method that relatively truly simulates wear and tear in relation to the age and the lifespan. The main difference from the tabular and linear methods is a more accurate determination of values in 3 areas that are shown in Fig. 1.

2 The technical value is the device´s technical life expectancy at the date of evaluation, in comparison with a completely new device and its expected lifetime.

![Fig. 1: Exponential depreciation - the choice of parameters P [5]](https://pl-master.mdcdn.cz/media/image/c16e8dd77c642bd1f6035b23b979bd0a.jpg?version=1537796417)

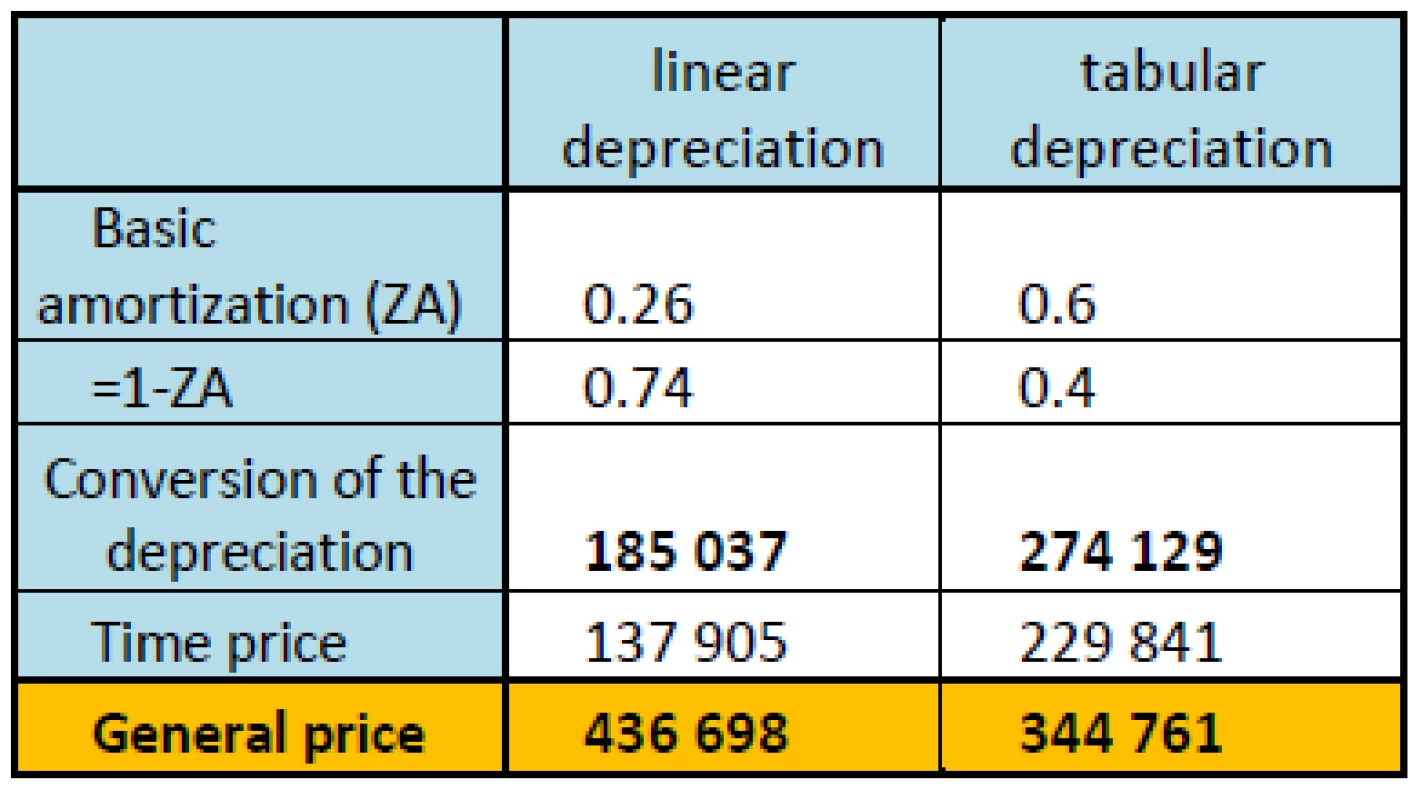

As shown in Fig. 2, the amortization is most problematic in the range of 70-130 % of the lifespan. Values from this range affect the final price of the valuated device so much that the final general price can vary by tens of percent. Hence, the appraiser must select a proper model of amortization. We show the effect of the model chosen to the final valuation in Tab. 1.

We have experimentally applied the calculation of the general price to artificial ventilation devices. The data were taken from data bases of public tenders for deliveries to various medical facilities in the Czech Republic over the past 5 years. We want to find out the price of an item, whose purchase price was CZK 685 322, whose age at the date of calculation is three years, and the life expectancy is 10 years. The results are shown in Tab. 1. The actual difference between the two resulting general prices is more than CZK 90 000, which is really a considerable price range comparing with the purchase price level.

The comparative method

The comparative (comparison, or comparable) method is based on the comparison and evaluation of certain parameters of devices that have the same or similar character. An important role is played by the method of paired comparisons and regression index of usability, published in [11]. The method is a combination of the multi-criteria decision analysis and the regression analysis. An important part of the method is the selection of suitable devices and their parameters or criteria to be considered. After the selection is finished, and criteria have been transferred maximization or minimization ones, we can proceed to assigning weights to individual items. This assigning is carried out only by experts in the field, who can rely on methods used in decision-making processes (regression analysis, the Saaty matrix), or on the basis of their own opinion. After that the definition of variables follows, and then paired comparisons of individual devices with the evaluated device. As a result we get indices of utilities of individual compared devices; consequently we perform a regression analysis. As a result we get a function, and we appoint the evaluated device into it. Hence, we have compared parameters of the device with themselves, the result being default price of the machine.

Conclusion

The paper presents partial results of a project investigating valuation of medical devices. However the methods mentioned are based on general valuation principles, medical devices require more care and some special considerations. The results find immediate application in expert analyses of medical technology purchases.

Acknowledgement

The work has been supported by a grant of Ministry of Health Services of the Czech Republic No. NT11532-5/2010 “Health Technology Assessment”.

Bc. Šárka Čížková

Ing. Zuzana Heinzová

Katedra biomedicínské techniky

Fakulta biomedicínského inženýrství

České vysoké učení technické v Praze

nám. Sítná 3105, CZ-272 01 Kladno

E-mail: sarka.cizkova@fbmi.cvut.cz

Labels

BiomedicineArticle was published in

The Clinician and Technology Journal

2012 Issue 2

-

All articles in this issue

- REAL-TIME PROCESSING OF MULTICHANNEL ECG SIGNALS USING GRAPHIC PROCESSING UNITS

- EYE TRACKING PRINCIPLES AND I4TRACKING® DEVICE

- MODELING OF CIRCULATION DYNAMICS WITH ACAUSAL MODELING TOOLS

- Methodology of thermographic atlas of the human body

- INDUCTION SENSORS FOR MEASUREMENT OF VIBRATION PARAMETERS OF ULTRASONIC SURGICAL WAVEGUIDES

- Linear Modelling of Cardiovascular Parameter Dynamics during Stress-Test in Horses

- MONITORING OF BREATHING BY BIOACOUSTIC METHOD

- APPLICATION OF TIME DOMAIN REFLECTOMETRY FOR CHARACTERIZATION OF HUMAN SKIN

- MATLAB AND ITS USE FOR PROCESSING OF THERMOGRAMS

- IDENTIFICATION OF MAGNETIC NANOPARTICLES BY SQUID BIOSUSCEPTOMETRIC SYSTEM

- EXPORT OF INFORMATION FROM MEDICAL RECORDS INTO DATABASE

- WIRELLES PROBE FOR HUMAN BODY BIOSIGNALS

- Written test on biophysics and medical biophysics at medical faculty, comenius university in Bratislava - a continuous check during two academic years

- VALUATION METHODOLOGY FOR MEDICAL DEVICES

- SETTING EMG STIMULATION PARAMETERS BY MICROCONTROLLER MSP430

- SOFTWARE PACKAGE FOR ELECTROPHYSIOLOGICAL MODELING OF NEURONAL AND CARDIAC EXCITABLE CELLS

- VENTILATOR CIRCUIT MODEL FOR OPTIMIZATION OF HIGH-FREQUENCY OSCILLATORY VENTILATION

- REHABILITATION OF PATIENTS USING ACCELEROMETERS: FIRST EXPERIMENTS

- CHANGES IN BIOIMPEDANCE DEPENDING ON CONDITIONS

- NONINVASIVE SYSTEM FOR LOCALIZATION OF SMALL REPOLARIZATION CHANGES IN THE HEART

- THE STRUCTURAL DESIGN AND USE OF HIGHER FORMS OF CONTROL IN REHABILITATION DEVICES

- MECHANICAL MODEL OF THE CARDIOVASCULAR SYSTEM: DETERMINATION OF CARDIAC OUTPUT BY DYE DILUTION

- AUTOMATIC SEGMENTATION OF PHONEMES DURING THE FAST REPETITION OF (/PA/-/TA/-/KA/) SYLLABLES IN A SPEECH AFFECTED BY HYPOKINETIC DYSARTHRIA

- A PHONEME CLASSIFICATION USING PCA AND SSOM METHODS FOR A CHILDREN DISORDER SPEECH ANALYSIS

- THE REAL-TIME VIZUALIZATION OF PNEUMOGRAM SIGNALS

- USE OF CORRELATION ANALYSIS FOR ONSET EPILEPTIC SEIZURE DETECTION

- FEEDBACK VISUALIZATION INFLUENCE ON A BRAIN-COMPUTER INTERFACE PERFORMANCE

- The Clinician and Technology Journal

- Journal archive

- Current issue

- About the journal

Most read in this issue

- MECHANICAL MODEL OF THE CARDIOVASCULAR SYSTEM: DETERMINATION OF CARDIAC OUTPUT BY DYE DILUTION

- MATLAB AND ITS USE FOR PROCESSING OF THERMOGRAMS

- VALUATION METHODOLOGY FOR MEDICAL DEVICES

- VENTILATOR CIRCUIT MODEL FOR OPTIMIZATION OF HIGH-FREQUENCY OSCILLATORY VENTILATION